Letter sent to The Chancellor today from Conservative MPs and former financial industry figures raising our concerns that the Financial Conduct Authority (FCA) may have inadvertently encouraged the culture within banking that led to Nigel Farage losing his Coutts account.

30th July 2023

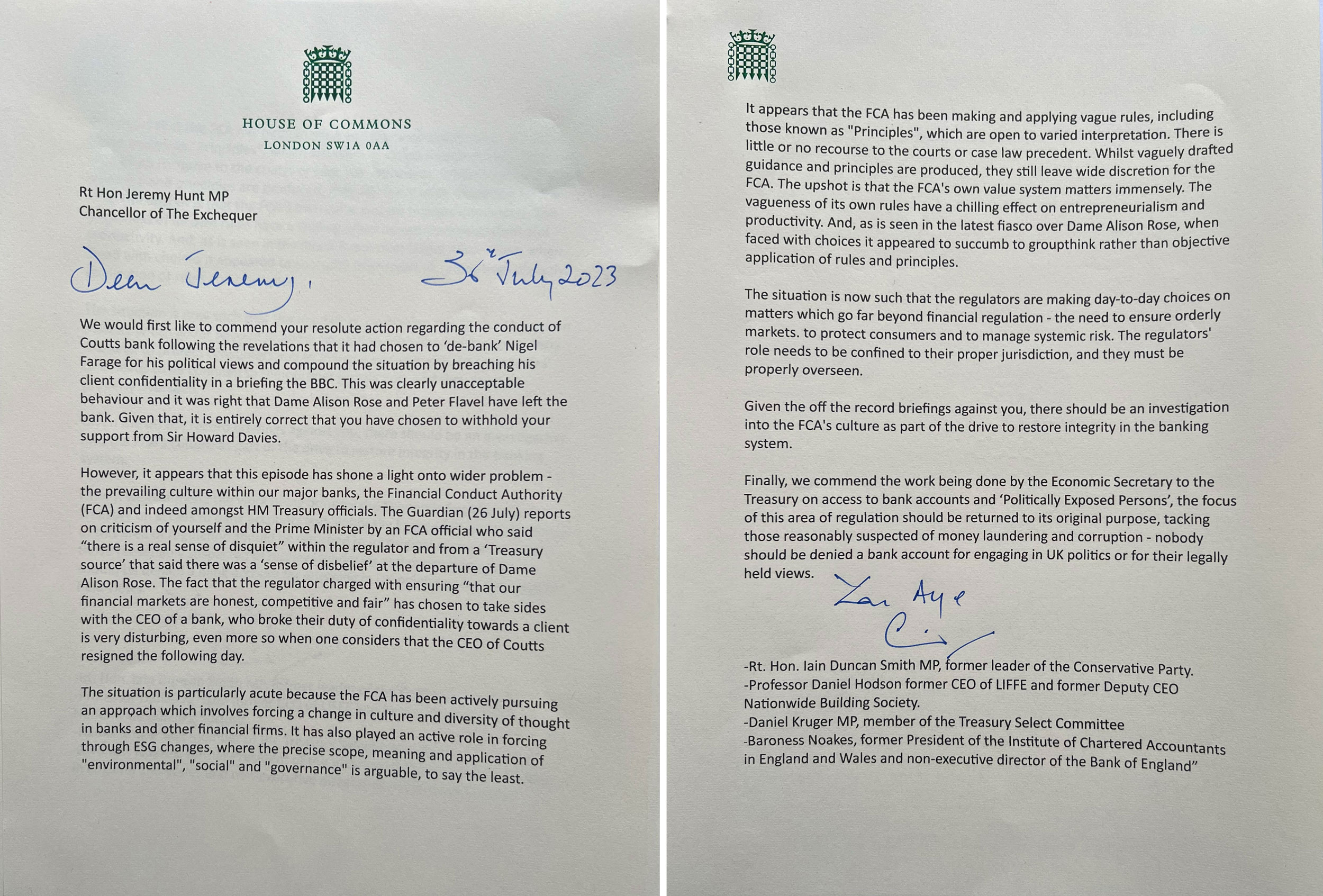

Dear Chancellor,

The Financial Conduct Authority and NatWest Bank

We would first like to commend your resolute action regarding the conduct of Coutts bank following the revelations that it had chosen to ‘de-bank’ Nigel Farage for his political views and compound the situation by breaching his client confidentiality in a briefing the BBC. This was clearly unacceptable behaviour and it was right that Dame Alison Rose and Peter Flavel have left the bank. Given that, it is entirely correct that you have chosen to withhold your support from Sir Howard Davies.

However, it appears that this episode has shone a light onto wider problem - the prevailing culture within our major banks, the Financial Conduct Authority (FCA) and indeed amongst HM Treasury officials. The Guardian (26 July) reports on criticism of yourself and the Prime Minister by an FCA official who said “there is a real sense of disquiet” within the regulator and from a ‘Treasury source’ that said there was a ‘sense of disbelief’ at the departure of Dame Alison Rose. The fact that the regulator charged with ensuring “that our financial markets are honest, competitive and fair” has chosen to take sides with the CEO of a bank, who broke their duty of confidentiality towards a client is very disturbing, even more so when one considers that the CEO of Coutts resigned the following day.

The situation is particularly acute because the FCA has been actively pursuing an approach which involves forcing a change in culture and diversity of thought in banks and other financial firms. It has also played an active role in forcing through ESG changes, where the precise scope, meaning and application of "environmental", "social" and "governance" is arguable, to say the least. It appears that the FCA has been making and applying vague rules, including those known as "Principles", which are open to varied interpretation. There is little or no recourse to the courts or case law precedent. Whilst vaguely drafted guidance and principles are produced, they still leave wide discretion for the FCA. The upshot is that the FCA's own value system matters immensely. The vagueness of its own rules have a chilling effect on entrepreneurialism and productivity. And, as is seen in the latest fiasco over Dame Alison Rose, when faced with choices it appeared to succumb to groupthink rather than objective application of rules and principles.

The situation is now such that the regulators are making day-to-day choices on matters which go far beyond financial regulation - the need to ensure orderly markets. to protect consumers and to manage systemic risk. The regulators' role needs to be confined to their proper jurisdiction, and they must be properly overseen.

Given the off the record briefings against you, there should be an investigation into the FCA's culture as part of the drive to restore integrity in the banking system.

Finally, we commend the work being done by the Economic Secretary to the Treasury on access to bank accounts and ‘Politically Exposed Persons’, the focus of this area of regulation should be returned to its original purpose, tacking those reasonably suspected of money laundering and corruption - nobody should be denied a bank account for engaging in UK politics or for their legally held views.

Yours sincerely,

Rt. Hon. Iain Duncan Smith MP, former leader of the Conservative Party.

Professor Daniel Hodson former CEO LIFFE, Deputy CEO Nationwide Building Society

Daniel Kruger MP, member of the Treasury Select Committee

Baroness Noakes, former President of the Institute of Chartered Accountants in England and Wales and non-executive director of the Bank of England